Capital budgeting is a multi-step process businesses use to determine how worthwhile a project or investment will be. A company might use capital budgeting to figure out if it should expand its warehouse facilities, invest in new equipment, or spend money on specialized employee training. With discounted cash flow analysis, you can look at cash flows, both inflow and outflow, that are part of the project and its longer-term maintenance, discounted back to today’s monetary value. Since inflation tends to devalue a dollar, this sets project costs in current dollars to compare with other current income and expenses. By taking on a project, the business is not only making a financial commitment but also investing in its longer-term direction that will likely influence future projects that the company considers. The capital budgeting process can involve almost anything, including acquiring land or purchasing fixed assets like a new truck or machinery.

Everything to Run Your Business

Identifying projects with projected large expenditure variances early is a key control in mitigating project waste. An effective financial analysis template should automatically calculate key financial metrics such as Net Present Value (NPV), Return on Investment (ROI) and Payback Period. A single method of Payback Period calculation should be employed, with a discounted accounting Payback Period being the most common. The benefit of automation is that the obvious items can be automatically included or excluded, and management attention can be focused on the marginal items.

Capital Budgeting and Long-term Investment Decisions

Total returns can help compare the performance of investments that pay different dividend yields. Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer. The Motley Fool reaches millions of people every month through our premium investing solutions, free guidance and market analysis on Fool.com, top-rated podcasts, filing your taxes late and non-profit The Motley Fool Foundation. The following example has a payback period of four years, which is worse than that of the previous example, but the large $15,000,000 cash inflow occurring in year five is ignored for the purposes of this metric. Prepare cash-flow estimates that start with projected revenues and deduct operating expenses, including loan payments.

Supports data-driven project decision-making

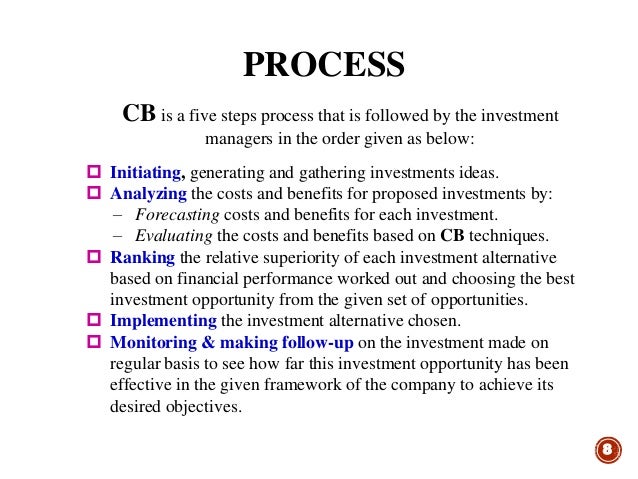

The capital budgeting process serves as a fundamental framework within project management, providing structured approaches for the evaluation, implementation, and monitoring of investment initiatives. PI evaluates relative profitability by comparing the present value of future cash flows to the initial investment. This straightforward technique calculates the time required to recover the initial investment through project cash flows. The payback period is calculated by subtracting annual cash flows from the initial investment until it is recovered. Any remaining amount is divided by the cash flow of the final year to determine the exact payback time. It is, therefore, required to exercise long-range planning when making decisions about investments in capital expenditure.

Evaluating the project

Therefore, capital budgeting allows decision-makers to analyze potential investments and evaluate which is the best to invest in. These tend to be large investments, as noted, but also projects that can last a year or more, which is another reason why making a reasoned decision is so important. Capital asset management requires a lot of money; therefore, before making such investments, they must do capital budgeting to ensure that the investment will procure profits for the company. The companies must undertake initiatives that will lead to a growth in their profitability and also boost their shareholder’s or investor’s wealth. Capital budgeting is a process that businesses use to evaluate potential major projects or investments.

Project completion rate

Companies are often in a position where capital is limited and decisions are mutually exclusive. Management usually must make decisions on where to allocate resources, capital, and labor hours. Capital budgeting is important in this process, as it outlines the expectations for a project. These expectations can be compared against other projects to decide which one(s) is most suitable. If the estimated profits are $500 for each of the next 3 years, and your initial investment was $1000, then your projected payback period is 2 years ($1000 / $500). This step-by-step approach to capital budgeting can be used by all types of businesses to analyze the viability of a long-term investment.

- The NPV, PI and IRR work well and are often relied upon because they are all based on time value of money.

- Some of this effort is dispersed across multiple responsibility areas, while others are centralized within a central Capital Expenditure (CapEx) control function.

- Therefore, management will heavily focus on recovering their initial investment in order to undertake subsequent projects.

- The primary advantage of implementing the internal rate of return as a decision-making tool is that it provides a benchmark figure for every project that can be assessed in reference to a company’s capital structure.

They need to keep a close eye on project costs and the budget, the performance of the project and the team executing it as well as the time to ensure that it’s delivered on schedule. Constraint analysis is used to select capital projects based on operation or market limitations. It looks at company processes, such as product manufacturing, to figure out which stages of the process are best for investing. It is always better to generate cash sooner than later if you consider the time value of money. To have a visible impact on a company’s final performance, it may be necessary for a large company to focus its resources on assets that can generate large amounts of cash. In taking on a project, the company involves itself in a financial commitment and does so on a long-term basis, which may affect future projects.

By identifying which variables have the greatest impact on project success, sensitivity analysis helps organizations understand project vulnerabilities and develop appropriate risk management strategies. By considering both the timing and magnitude of cash flows, this technique provides a more accurate assessment of how long it will take to recover the initial investment. Map out possible threats including market risks, operational challenges, regulatory changes, and technological obsolescence. Consider both internal and external risk factors that could impact project success and financial performance over time. Encourage cross-functional teams to propose innovative investment opportunities through structured brainstorming sessions and regular business reviews. This proactive approach helps identify potential projects that could enhance operational efficiency, expand market reach, or introduce new products and services into the market.

Organizations must consider factors like GDP growth, inflation rates, currency fluctuations, and potential policy changes that could impact project success. Tax considerations involve analyzing the impact of depreciation, tax shields from interest payments, and applicable tax rates on project cash flows. This technique provides a more realistic assessment of project returns and helps avoid the multiple IRR problem that can occur with unconventional cash flow patterns. By incorporating managerial flexibility and strategic alternatives into the evaluation process, real options analysis helps organizations understand and quantify the value of different strategic choices within a project.